Garnishments are court orders or levies from the IRS that direct employers to withhold a particular amount from an employee’s paycheck within the curiosity of repaying money owed. Employers in Texas are free to undertake policies or contracts that establish vacation time at an amount of their choosing. Principally, employers aren’t legally required to supply any company-wide PTO insurance policies, and any vacation or PTO coverage that they do establish should adhere to the Texas Labor Code.

Understanding Employment Taxes

People who process Forms W-2 might e-file Forms W-2 instantly with the Social Safety Administration by way of their Business Services On-line. Simply compare payroll providers in just some clicks utilizing our side-by-side comparability device, which summarizes user evaluations, features, rankings, and how each provider stacks up in opposition to each other. Employers must deposit these withheld taxes in accordance with IRS schedules – typically month-to-month or semi-weekly, depending on the employer’s complete tax legal responsibility. Cassie is a former deputy editor who collaborated with teams around the world while living in the lovely hills of Kentucky. Prior to becoming a member of the group at Forbes Advisor, Cassie was a content material operations manager and copywriting supervisor.

FICA tax is paid by both workers and employers, although only workers pay federal income tax and the Extra Medicare tax. With Rippling’s payroll software, you presumably can easily sync your business’s HR data with payroll, eliminating the need for guide data entry or tax calculations. It handles all of your compliance needs, together with Texas minimal wage and native labor laws, and ensures timely submitting of federal and Texas state payroll taxes automatically with the related businesses.

Employers have simply eight days to let their insurer know about their employee’s declare. Relying on the situation, staff might have to visit a doctor to turn into eligible to receive workers’ comp benefits. The Social Safety tax part of FICA tax requirements in Texas mandates that employers and their employees contribute 6.2 p.c of any earnings up to $147,000. Per FICA requirements, employers must match an employee’s quantity and contribute the funds to the Social Safety Belief Fund to assist incapacity insurance coverage along with Medicare advantages and retirement earnings.

Some states collect additional payroll taxes for issues similar to workforce growth, incapacity insurance and transit. Consult an accountant in your state to learn which taxes your business is liable for paying or deducting from payroll. Managing payroll tax Texas requirements could be advanced, particularly for first-time business owners.

- Texas employers can discover more information on labor legal guidelines, taxes, and enterprise growth through state authorities sources.

- As a small business owner, it’s sensible to turn into conversant in these finest practices.

- Employers have to pay Texas UI tax on the primary $9,000 that each of their workers makes in a single calendar 12 months.

- Employers who renege on their new hire reporting duties face a penalty of $25 for every occurrence by which they don’t furnish a brand new hire report.

How You Can Have An Effect On Your Texas Paycheck

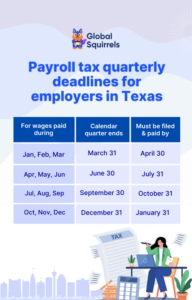

Particularly, funds are due by the last day of the month following every quarter’s end until that date falls on a weekend or authorized holiday. Having to adjust to distinctive state taxes and wage laws could make processing payroll doubly daunting. Here’s everything you have to learn about these charges and legal guidelines for the state of Texas. If your group is growing in Texas or you might have a team member working remotely within the Lone Star state, it’s essential to know that payroll tax rules differ from state to state. Due To This Fact, it’s crucial to obviously perceive tax laws in all of the states the place your staff reside.

Per the Texas Payday Legislation, employers can only use digital transfers, checks, or cash to pay their staff on paydays except an worker agrees to an alternative type of payment in writing. The Texas Payday Regulation, beforehand the Texas Payment of Wages Act, details fee obligations that employers should adhere to when paying their staff throughout a calendar year. The regulation applies only to personal employers and never public employers or independent contractors, and it defines how these public employers can launch wages to their employees. Wages, as outlined by the Texas Payday Law, include payments issued for PTO or sick go away as properly as for severance and even parental leave pay. Both federal, as well as Texas state legal guidelines, require that enterprise homeowners submit their new rent info to the Employer New Hire Reporting Operations Center within the Texas Office of the Attorney General.

Learn our complete information on the way to calculate payroll when you need further assist. At the federal degree, all Texas employees are eligible for up to twelve weeks of unpaid, job-protected depart under the Family and Medical Depart Act (FMLA). Right Here is a complete list of the Texas labor and HR laws that your Texan enterprise should know. The IRS costs a late payment when you don’t deposit the employment tax you owe on time, called a Failure to Deposit Penalty. There’s no most taxable restrict for Medicare tax, so that you and the employee would proceed to split the two.9% tax on earnings over $176,a hundred, even though those earnings wouldn’t be subject to the Social Safety tax.

Companies with less than 1,000 employees can submit on-line using a CSV report or an Excel, handbook input, entry primarily based on the earlier report, or a No Wages report if they didn’t pay wages that quarter. The above words discuss with a quantity of sorts of taxes that small firm house owners should pay attention to while handling payroll in Texas, plus there are a few extra federal taxes that businesses should pay. Owners must pay 6% of their staff’ first $7,000 in yearly earnings to the FUTA. FUTA urges firm house owners to analyze if they are eligible for a federal tax benefit to pay to FUTA.

From minimum wage necessities to unemployment taxes, there are a couple of highlights each Texas employer should bear in mind. In Texas, employers should pay just one payroll tax on the state degree, which is the unemployment insurance tax. This tax is an element of https://www.quickbooks-payroll.org/ the nationwide program administered by the US Division of Labor. Neither employers nor employees are mandated to pay state earnings tax in Texas. Corporations in Texas are responsible for state payroll taxes and federal payroll FICA taxes, such as Medicare tax and Social Security taxes. Texas has a really simplified tax construction that can increasingly benefit employers.

Federal revenue taxes are the primary employer taxes in texas federal taxes that Texas employees should pay. Your employees should deduct a sum for income tax based on their preferences on the IRS Form W-4. Sure, a payroll supplier or tax preparer can deal with payroll calculations, put together returns, and submit funds for an employer.

Comentarios