The strategies discussed, together with FIFO, LIFO, and Weighted Common Price, supply totally different approaches to stock valuation, every with its implications for financial reporting and tax liabilities. Various strategies just like the Gross Profit Technique and Retail Inventory Method provide useful estimates when physical counts are impractical. To discover the ending stock, start with the fundamental method that includes the price of items out there and select from methods like FIFO, LIFO, or weighted average cost. In this guide, we will present you how to discover the ending stock by breaking down each step that will assist you precisely value unsold goods at the end of your accounting interval. Superior stock management software automates duties and enhances accuracy by monitoring, streamlining information entry, and lowering human errors.

Weighted average technique (WAC) is determined by dividing the entire quantity you spent on the inventory you have on hand by the total number of objects available. This offers an averages of the value of purchased items in your ending inventory. For instance, let’s use the identical example as above of buying 5 of one SKU at $15 every after which one other 5 of the identical SKU at $20 each.

We will proceed the dialogue beneath the weighted average method and calculate a price per equivalent unit. Ending inventory refers to the sellable inventory you have left over at the end of an accounting period. When a given accounting period ends, you’re taking your beginning stock, add internet purchases, and subtract the price of goods sold (COGS) to find your ending inventory’s worth. For a steadiness sheet to be full, you’ll want to say all stock as an asset. Knowing your ending stock value will impression your stability sheets and your taxes, so it’s necessary to calculate the worth of your inventory appropriately. Correct ending stock is crucial as a end result of it immediately impacts financial reporting, COGS, gross revenue, and tax obligations, guaranteeing the enterprise maintains correct cash move and budgeting.

Step By Step Solution:

These methods present real-time visibility of stock levels, preserving information up-to-date. Regular bodily inventory counts are important for maintaining correct information, figuring out discrepancies between recorded and precise stock levels, and making certain data reliability. Ending inventory refers to the complete worth of products that an organization has readily available and out there for sale at the conclusion of an accounting interval. This determine is crucial for accurate monetary reporting and inventory administration. In the earlier web page, we mentioned the physical move of units (step 1) and the way to calculate equivalent units of production (step 2) underneath the weighted common method.

Normally, it’s recorded on the stability sheet at a lower price or its market value. Likewise, you want to know the precise revenue assertion i.e how much income you’re making on what you’re selling. As Soon As you calculate ending inventory, you’ll have a clear understanding of whether your precise stock matches the recorded stock. If the numbers don’t match up, this could presumably be an indication that you’re paying too much for the preliminary purchase of goods based on present market value, or that it’s time to rethink your pricing technique. The net purchases are the items you’ve bought and added to your inventory depend.

For instance, during the fiscal year you began with a starting inventory steadiness of 100 items at $2.50 each. Your ending inventory would include 400 objects valued at $3.25 each, with a complete value of $1,300 (assuming no purchases were made during this time). The Gross Revenue Methodology estimates ending inventory primarily based on the gross profit margin, the percentage of profit remaining after subtracting manufacturing prices.

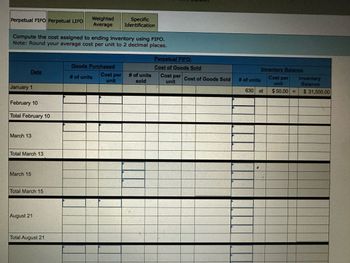

For example, with web gross sales of $1,000,000 and an expected gross revenue margin of 30%, the COGS could be estimated at $700,000, resulting in an ending stock of $570,000. The Final In, First Out (LIFO) methodology assumes that the most lately bought stock is the first to be bought, usually leaving older, cheaper objects in the ending inventory. For example, with a beginning stock of $5,000, stock purchased totaling $2,400, and COGS of $1,a hundred and seventy, the ending inventory could be $6,230. To decide COGS utilizing FIFO, you must multiply the number of models bought by their respective prices per unit, based on their chronological buy order.

What’s The Primary Formulation For Calculating Ending Inventory?

The gross revenue (or margin) could be $11,800 ($19,000 Sales – 7,200 value of goods sold). The journal entries for these transactions could be would be the same as present above the only thing altering would be the AMOUNT of price of products sold used within the Jan eight and Jan 15 entries. Beneath this, the common value per unit is computed by dividing the entire https://www.personal-accounting.org/ value of goods obtainable on the market. Ending Inventory is valued by multiplying the average value per unit by the variety of items available at the finish of the reporting period.

What’s The Ending Inventory Formula?

Every technique has advantages and implications for tax legal responsibility compute the cost assigned to ending inventory, profitability, and inventory value. This is the worth of the unsold or unused stock at the finish of the accounting interval. It impacts the stability sheet, monetary ratios, and the amount of tax you pay. Ending inventory affects the balance sheet, the place it’s a current asset. On the income assertion, ending stock influences the COGS and gross profit. You’ll use it to determine your value of products sold (COGS), assess the business’s financial well being, and plan production and buying.

- Inaccurate inventory can result in tax issues, misreported earnings, and poor decision-making.

- We do the identical of ending work in course of however using the equivalent units for ending work in process.

- Regularly evaluating calculated ending inventory with physical counts identifies shrinkage attributable to theft, harm, or errors.

- Schedule a demo and see how streamlined picking can help smarter inventory valuation.

Know-how simplifies ending stock administration by automating monitoring by way of third-party logistics (3PLs), providing real-time reporting and streamlining processes. These systems observe stock movements and supply immediate updates, decreasing manual effort. Cloud-based inventory management methods offer scalability and real-time monitoring, growing with organizational wants and managing large volumes of data. Implementing these methods leads to more environment friendly stock administration, supporting higher decision-making and business efficiency.

It is smart to keep track of the Inventory as the same is carried forward to the subsequent reporting period (Accounting or Financial) and turns into the Starting Inventory. Any inaccurate measure of Ending Stock will end in financial implications in the new reporting period. A high turnover ratio is generally optimistic, as stock is quickly bought. However, it could additionally recommend that the corporate has inadequate inventory to meet demand and could run out of inventory. It is, therefore, ideal for companies with expensive and distinguishable objects, like automotive dealers.

Comentarios